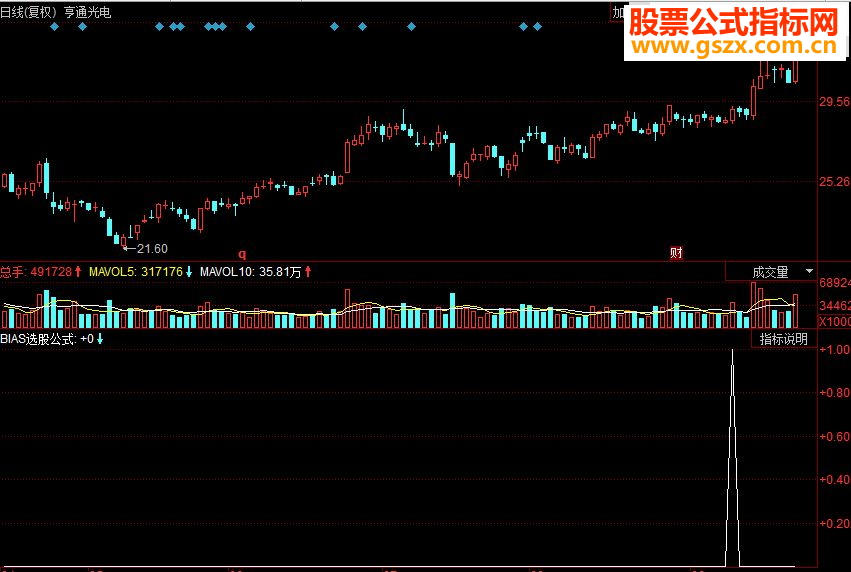

乖离率表现个股当日收盘价与移动平均线之间的差距。正的乖离

率愈大,表示短期获利愈大,则获利回吐的可能性愈高;负的乖

离率愈大,则空头回补的可能性愈高。按个股收盘价与不同天数

的平均价之间的差距,可绘制不同的BIAS线。

BIAS :=(CLOSE-MA(CLOSE,5))/MA(CLOSE,5)*100;

BIASMA :=MA(BIAS,5);

AA:=CROSS(BIAS,BIASMA);

VOL1:=MA(VOL,5);

BB:=CROSS(V,VOL1);

BIAS36:=MA(CLOSE,3)-MA(CLOSE,6);

MABIAS:=MA(BIAS36,6);

CC:=CROSS(BIAS36,MABIAS);

BIAS11:=(C-MA(C,6))/MA(C,6)*100;

BIAS21:=(C-MA(C,12))/MA(C,12)*100;

BIAS31:=(C-MA(C,24))/MA(C,24)*100;

BIAS1:=(BIAS11+2*BIAS21+3*BIAS31)/6;

乖离:=MA(BIAS1,3);

DD:=CROSS(BIAS1,乖离) ;

AA AND BB AND CC AND DD;